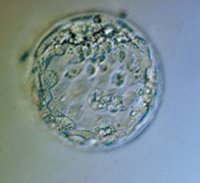

Sen. Majority Leader Bill Frist announced yesterday that he intends to bring up a three-bill package that would provide federal funding for stem-cell research for a vote before the Senate takes a break for the mid-term elections in October (according to the AP) or July (according to CNN, the Washington Post, and the Wall Street Journal).

Sen. Majority Leader Bill Frist announced yesterday that he intends to bring up a three-bill package that would provide federal funding for stem-cell research for a vote before the Senate takes a break for the mid-term elections in October (according to the AP) or July (according to CNN, the Washington Post, and the Wall Street Journal).Here's the summary of the Senate's unanimous-consent agreement on Frist's plan (from the Congressional Record's Daily Digest for June 29):

Stem Cell Research Legislation--Agreement: A unanimous-consent agreement was reached providing that at a time determined by the Majority Leader, after consultation with the Democratic Leader, Senate begin consideration en bloc of H.R. 810, to amend the Public Health Service Act to provide for human embryonic stem cell research, and S. 2754, to derive human pluripotent stem cell lines using techniques that do not knowingly harm embryos, and S. 3504, to amend the Public Health Service Act to prohibit the solicitation or acceptance of tissue from fetuses gestated for research purposes, that both bills be discharged from the Committee on Health, Education, Labor, and Pensions; that there be 12 hours of debate equally divided between the Majority and Democratic Leaders, or their designees; that no amendments be in order to any of the bills; that following the use, or yielding back of time, the bills be read a third time, respectively, and the Senate begin three consecutive votes on final passage of the bills in the following order: S. 3504, S. 2754, and H.R. 810; provided further, that any bill that does not receive 60 votes in the affirmative have its votes on passage be vitiated, and that those bills be returned to the calendar or to the Committee on Health, Education, Labor, and Pensions; and that it not be in order for the Senate to consider any bill or amendment relating to stem cell research during the remainder of the 109th Congress.

The action is set out at pp. S7169-S7173 of the Congressional Record for June 29.